Construction Tax Fraud: Cheaters In The Industry

What is Construction Tax Fraud?

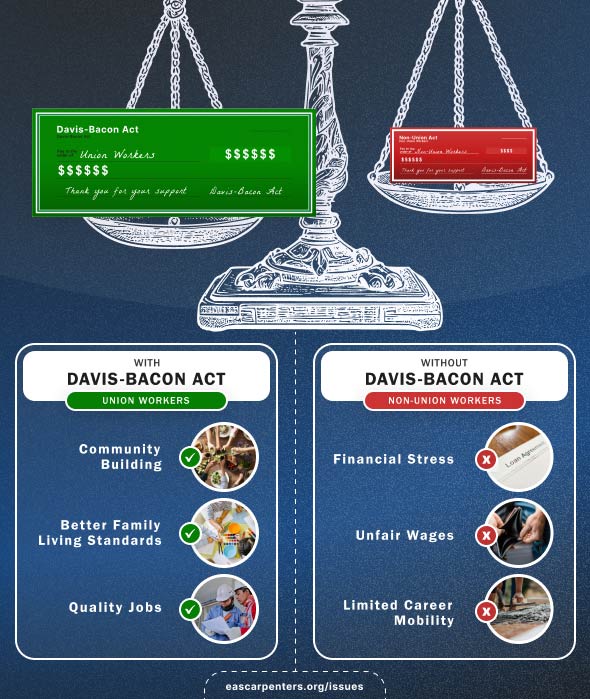

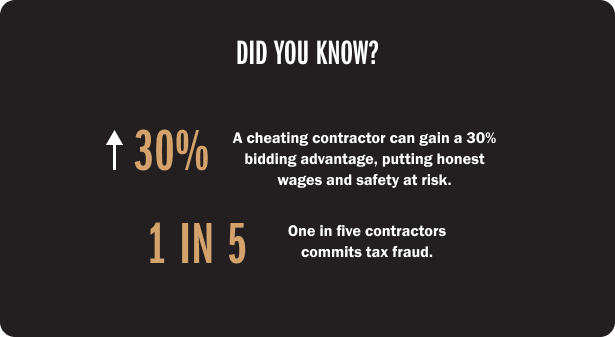

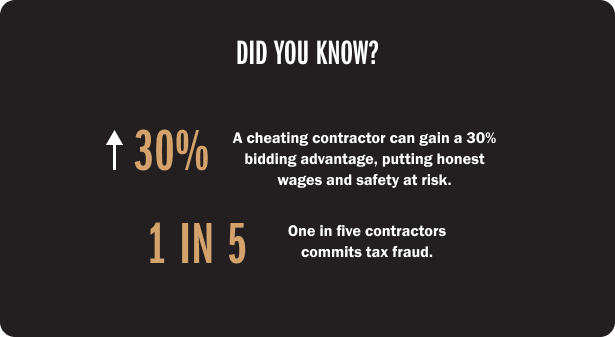

Tax fraud in the construction industry hurts everyone—workers, taxpayers, honest contractors, and local communities. Cheating contractors commit tax fraud by misclassifying workers as independent contractors, committing wage theft, using labor brokers, and paying workers under the table.

These tactics allow them to dodge taxes, avoid paying workers’ compensation, and skip out on local taxes that fund public services like schools, infrastructure, and social programs. The result? Workers are underpaid and unprotected, and communities lose vital funding for essential services.

Why Tax Fraud Hurts Us All:

- Cheaters Cheat Us All: When contractors avoid taxes, they drain funds meant for public services like schools, roads, veterans’ services, and social security.

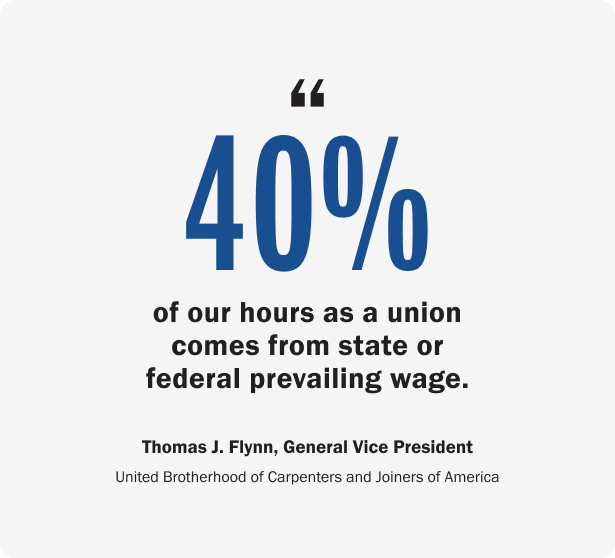

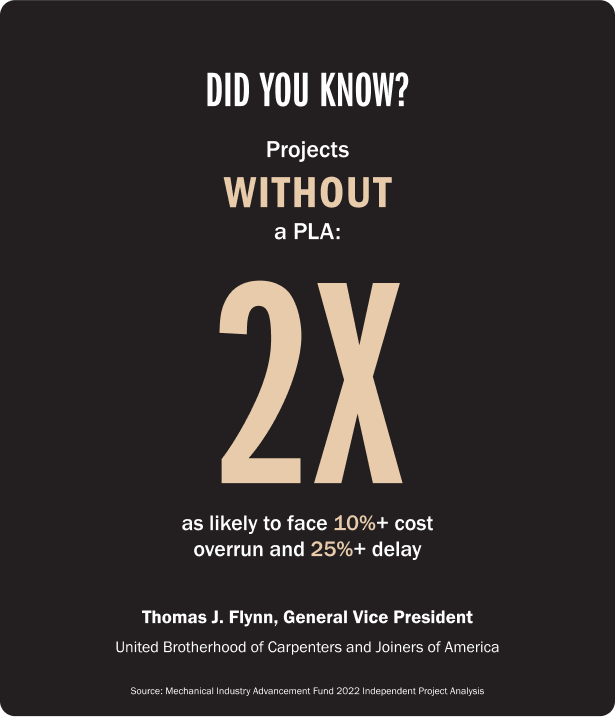

- Unfair Competition: Honest contractors are undercut by those who lower their costs illegally.

- Billions in Losses: Every year, tax fraud costs the public $10 billion, leaving the rest of us to pick up the tab.

- Workers Get Burned: Fraudsters cheat workers out of fair pay, overtime, benefits, and protection from injury.

What Needs to Be Done:

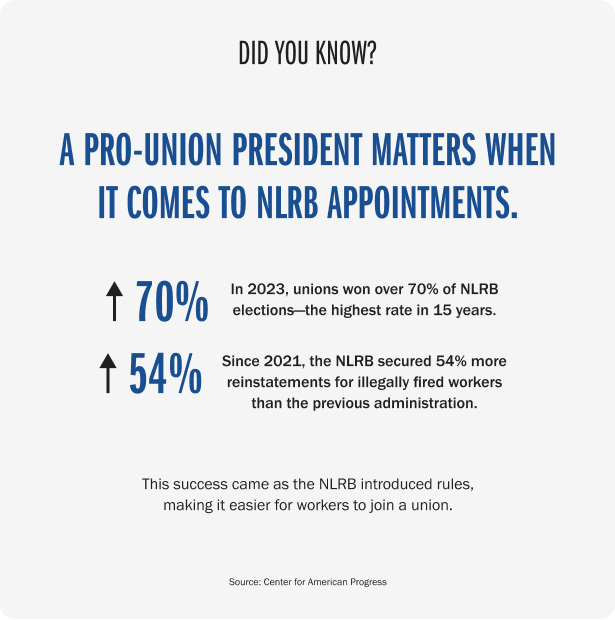

Our members work tirelessly to educate the public about construction tax fraud, but it’s not enough.

We need stronger enforcement from our leaders and government agencies to hold these fraudulent contractors and labor brokers accountable. Raising fines, closing loopholes, and increasing resources for investigation and prosecution are critical to stopping these greedy practices.

Key Terms Members Should Know:

- Wage Theft: Workers get shortchanged on pay and overtime.

- Tax Dodgers: Contractors fake records to dodge taxes.

- Misclassification: Workers are wrongly labeled as independent contractors to avoid benefits and protections.

- Under-the-Table Payments: Cash payments evade payroll taxes and worker protections.

Don’t Let Tax Cheats Off the Hook!

Educate, organize, and demand tougher enforcement to protect workers and our communities.

The EAS Carpenters Union stands against tax fraud. Learn how to fight back!

LEARN MORE →